Financial Management

Good financial management is essential for a centres sustainability and is an important part of good governance. It is important every committee member understands a centres accounts and financial reports.

Financial Management “as the planning, directing, monitoring, organising, and controlling of the monetary resources of an organisation in such a manner to best contribute to helping an organisation accomplish its objectives.”

A Centre is accountable and responsible to its members, and to LANSW. The Centre must provide a Financial Report to its members at the Annual General Meeting and must forward a copy of the Report to LANSW and to the Zone/Region.

A treasurer’s first responsibility is, as custodian of the Centre’s fund, and these funds must be dealt with according to the Centre’s constitution and the wishes of the Centre members. The treasurer must keep a proper record of where money comes from and show exactly where money was approved and spent. Once the Centre’s money has been banked, there trusteeship falls on the committee. The Committee must review the accounts for payment and the general financial operations at each committee meeting.

If you are involved with a new Centre, you may like to approach people with experience in finance to help you set up your financials records. A local bank manager or accountant may be sympathetic to your cause and be willing to assist you.

Further tips on managing your Centres finance:

Specific information for Treasurers, in managing your Centres finance.

Information for all Committee Members about a Centres finance.

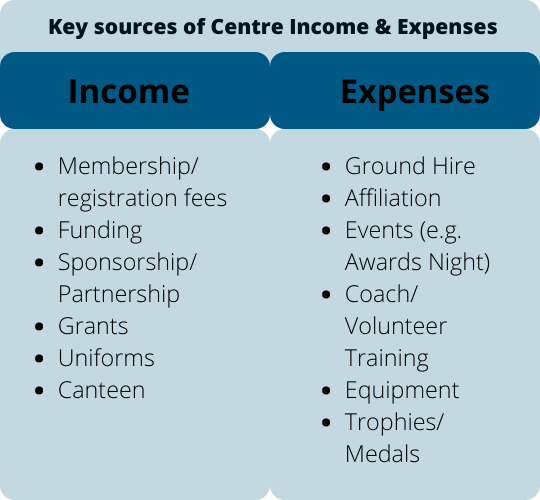

Income Streams

Having a variety of different income streams helps with a centre’s sustainability, also eliminates the pressure of gaining all financial requirement needs from just memberships as the main source of income. This as a result will see the lowering or consistent membership fees, will provide money for upgrading equipment, investment into coaching and volunteer education and offers the ability for centres to achieve long term goals such as modernising their systems to be more attractive for members.

Income streams to be considered by centres include:

b) Grants

c) Fundraising

d) Centres Membership Fees

e) Merchandising

f) Hire of Facility & Equipment

Financial Planning- Budgeting

A budget is a way of thinking ahead financially. It is a projected estimate of your income and expenditure and is intended to minimise the risk of being faced with financial surprises resulting in an operating loss. As many centres operate with little to no capital reserves, an operating loss may have a devastating impact.

By preparing a budget, you will be able to see whether your income is likely to exceed your expenditure, and if so by how much. Preparation of a budget can also assist in determining fundraising requirements and registration fees for the season.

Budgeting Definitions.

Capital Reserves: Amount retained in the account in order to meet probable or possible future demands.

Deficit: The amount by which spending exceeds income over the year.

Operating Loss: An operating loss occurs when your deductions are more than your income for the year.

Surplus: The amount by which income exceeds spending over the year.

Who Should Prepare the Budget?

How to Prepare the Budget?

The treasurer does not usually prepare the budget alone. It is important that the process of preparing the budget involves everybody who is going to be affected by it. It is therefore recommended that, whilst the treasurer should be responsible for the preparation of the budget, consultation throughout the process needs to take place with the entire centre committee. The final draft of the budget should then be agreed to and endorsed by the committee.

Financial Reporting

All centres, no matter their size, need sound practices for regulating and recording financial transactions. The treasurer is responsible reporting the financial status of the centre to the committee on a regular basis and comparing the financial performance of the centre with the budgeted performance.

A centres annual financial statement is required to be reviewed prior to the centre’s Annual General Meeting (AGM) by an independent person. This person must be competent to assess the financials and be approved by the Committee.

All completed financial documents should be within the Annual Financial Report and uploaded as part of Affiliation.